philadelphia wage tax work from home

The City Wage Tax is a tax on salaries wages commissions and other compensation. The tax applies to payments that a person receives from an employer in return for work or services.

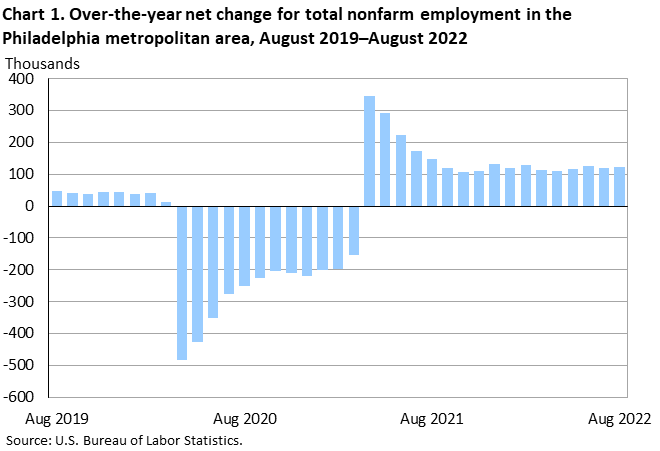

Philadelphia Area Employment August 2022 Mid Atlantic Information Office U S Bureau Of Labor Statistics

Workers can change their tax status and be exempt from the City of Philadelphias City Wage Tax of 34481 until June 30 2020 and 35019 beginning July 1 2020.

. June 16th 2021. The net profits tax is 39102 for Philadelphia residents and 34828 for non-residents. Unlike the business income receipts tax.

People who live in municipalities with their own earned. The wages of the nonresident employees of both A and B teams are subject to Wage Tax only for the weeks they are working at the Philadelphia location. Non-residents who work in Philadelphia must also pay the Wage Tax.

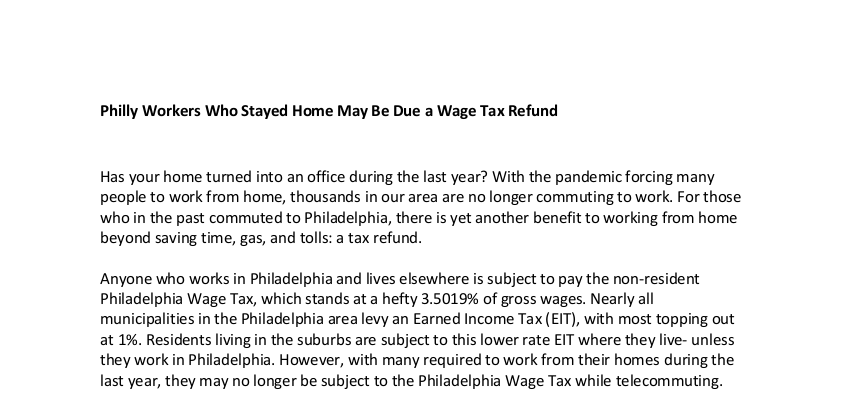

This tax is in addition to the business income and receipts tax. For those who used to commute to work in Philadelphia there is yet another benefit to working from home besides saving time gas and tolls. Workers will essentially receive a 34481 increase in take-home pay during the time they are working from home.

Effective July 1 2021 the rate for. Anyone who works in. Someone working from home in the suburbs during the pandemic making 60000 per year would be subject to their home municipalitys EIT which is.

Due to social distancing rules an. The wages of non-resident employees who are part of the category of employees who must work in the Philadelphia work location are subject to Wage Tax provided. So you might think non-residents who.

Normally Philadelphia non-residents employed in the city can get a wage tax refund for days they worked outside of Philadelphia. As long as companies are requiring employees to work from home they are. Upper Makefield residents who worked from home for a Philadelphia-based business during the Covid-19 Pandemic may receive yet another benefit to.

The simple answer is yes. Nonresident employees who had Wage Tax withheld during the time they were required to perform their duties from home outside of the city in 2020 can request a refund. All philadelphia residents owe the city wage tax regardless of.

Effective July 1 2021 the rate for residents is 38398 percent and the rate for non-residents is 34481 percent.

Philly City Council Reviews Pandemic Impact On Finances Whyy

Pa Department Of Revenue Issues Remote Work Guidance Wouch Maloney Cpas Business Advisors

U S Supreme Court Decision Imperils A Portion Of Wage Tax In Philadelphia And Wilmington Officials Unwilling Or Unable To Estimate Likely Budget Impact Whyy

The Cost Of Living In Philadelphia More Affordable Than Most Big Cities

I Ve Been Working My Philadelphia Based Job From Home In The Suburbs Do I Need To Pay Philadelphia Wage Tax Canon Capital Management Group Llc

How Working From Home Could Affect Your Tax Bill 6abc Philadelphia

Philadelphians Who Work Outside Pa Could Be Eligible For Wage Tax Break Whyy

Sparing Philadelphia Homeowners From Increasing Property Tax Burdens

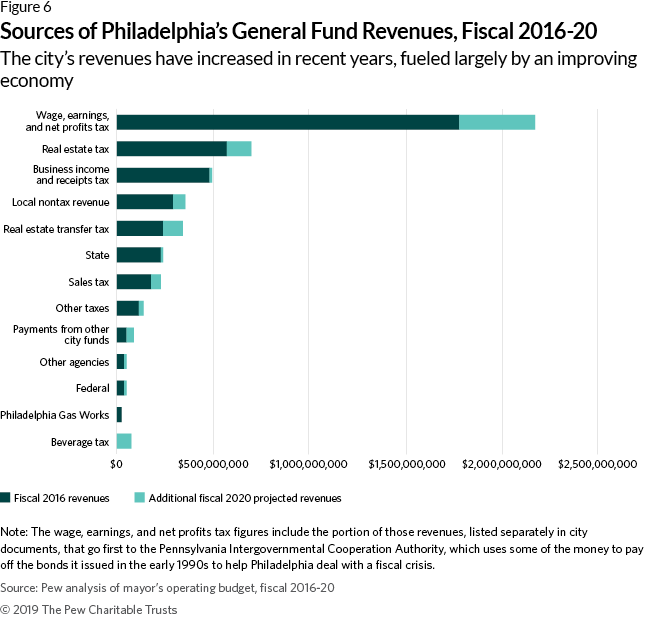

How Future Employment Patterns Could Put Philadelphia S Operating Budget At Risk The Pew Charitable Trusts

Philadelphia Is Richer Than It Was In 2016 So Where S All That Money Going

How Did The Pandemic Affect Philly S Wage Tax Generocity Philly

The Tax And People Implications Of A Remote Workforce Bdo

Philly S City Wage Tax Just Turned 75 Here S Its Dubious Legacy Technical Ly

Philly Workers Who Stayed Home May Be Due A Wage Tax Refund Newtown Township Bucks County Pennsylvania

Philly Wage Tax To Be Lowered In New City Proposal Whyy

Pennsylvania State Tax Updates Withum

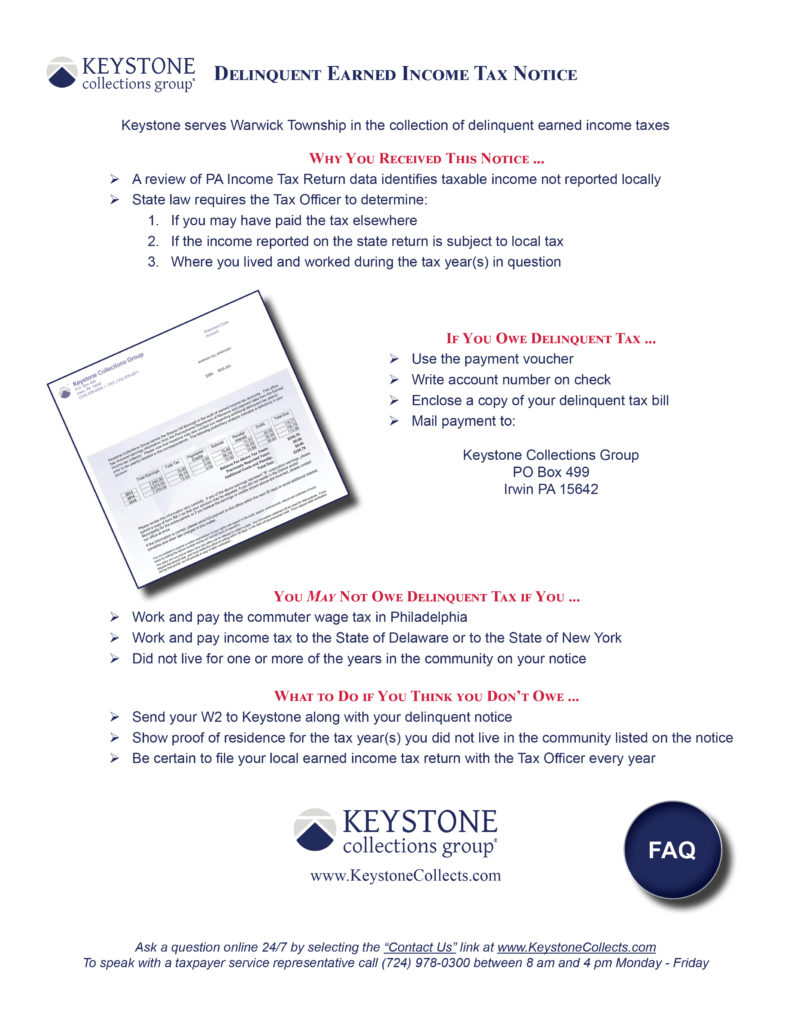

Taxes Warwick Township Bucks County

Who Is Entitled To A Wage Tax Refund Department Of Revenue City Of Philadelphia

Here Are Tax Workarounds For Entertainers Working In Various States